Loan Signing Agent Vs Notary | What Is The Difference?

One of the most important financial decisions you will ever make is getting a mortgage. For your real estate acquisition, you may have obtained a financial institution that requires you to sign the documents yourself with a loan signing agent or a notary. This typically occurs when you are not working with a mortgage consultant or after you have located an internet lender.

Signing with a trained and knowledgeable notary or loan signing agent may be a better option than using your real estate lawyer to sign your mortgage documents, as the latter would incur additional fees on top of your purchase costs.

It can be difficult to determine which of the two is best for your circumstances, but you are in luck because I have done enough research to hopefully help you decide which approach to take with your mortgage documents.

What is a Loan Signing Agent?

A loan signing agent often costs a one-time fee (not per signature), is well-versed in the various documents that may be included in a transaction, has seen and signed a significant number of loan agreements, and is well-versed in how to examine and complete each document. They understand how to steer clear of common problems and errors. They are aware of the requirements for signatures, initials, stamps, and any other formalities that certain financial institutions like to impose when loan applications are signed. Additionally, they will be able to connect you with your lender or escrow office to address any specific inquiries you may have about your transaction.

Loan signing agents can also notarize documents, however, not all loan document need to be notarized (most of them don’t need to be).

Typical documents that do require a notarized seal include:

- The final mortgage contract itself. This is not the document that will be registered on title of the property.

- The deed of trust is the most important document you will need to sign and requires proper care when executing to ensure to correct information is going on title.

- Proof that the witness has checked your identification documents.

- Any second mortgage or bridge financing contracts.

- Any legal affidavit or sworn document that the bank requires will need to be accompanied by a signed and notarized affidavit. For example, some mortgage companies require a mortgagor to swear that they are one and the same person as an alias or other named they’ve used, that they’re a citizen of the United States, or a letter of owner occupancy.

Any of these documents can be notarized by either a notary or a loan signing agent.

Is It Better to Use a Loan Signing Agent or a Notary?

The choice of who you want to witness the signing of your loan agreement is ultimately yours, but we strongly advise you to thoroughly investigate your options before selecting the first agent or notary that appears in your Google search results (or the yellow pages if you still use a phone book).

It is critical to evaluate costs and account for potential future costs and issues that could occur from improperly executed documents. As previously stated, this is a significant life decision, and in order to be considered for and get your mortgage funds, you will need to sign a number of forms. The last thing you want is to be caught off guard and miss a date, initial, or signature on a crucial document.

We at Motary Notary are committed to providing all of our clients with comprehensive information on the signing procedure. We have a great deal of experience and have dealt with a variety of loan documents.

Would you like more information about whether a loan signing agent is appropriate for your circumstances?

Reach out for a conversation today! Email trsss@motarynotary.com or call/text me.

Tammy Rene Stephens, Notary Public Since 2020

Tammy Rene Stephens

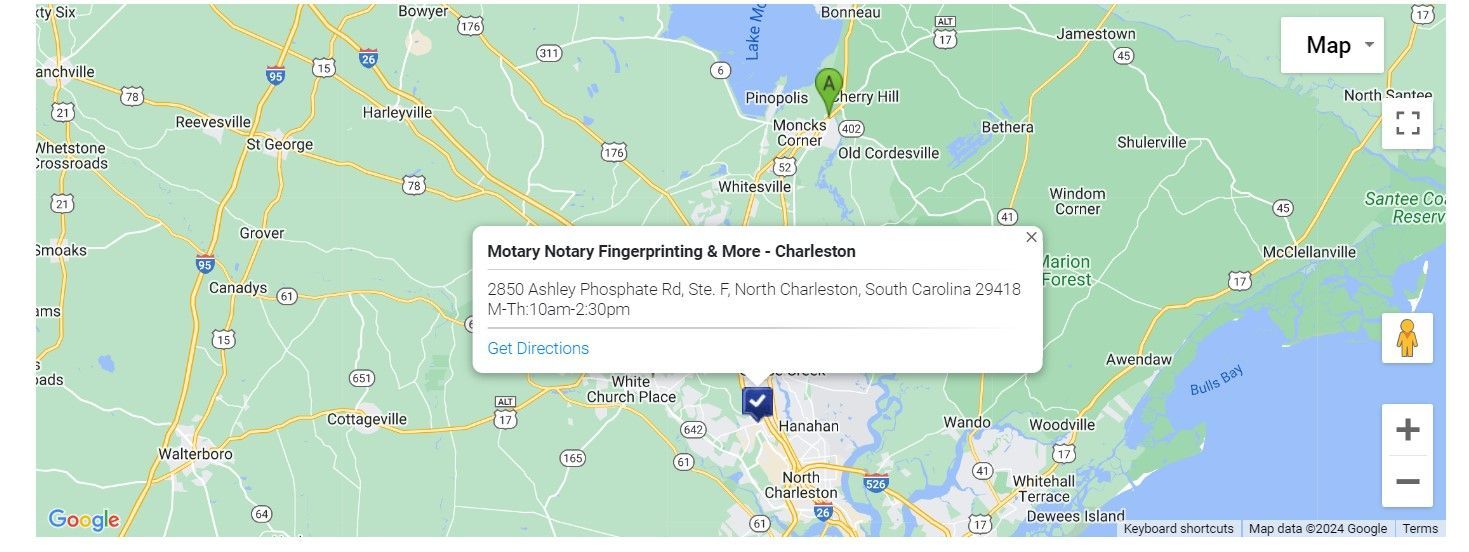

Motary Notary Fingerprinting & More

Mobile Notary Since 2020

Call/Text: 843-804-0429

Email:

trsss@motarynotary.com